Remember the mantra!

Okay, fans of The Legal Genealogist, here’s your pop quiz for today.

What’s the mantra around these parts?

Yep, you know it. You can probably recite it in your sleep:

If we want to understand the records, we have to understand the law — at the time and in the place where each record was created.

Case in point: today’s reader question, raising yet another “how old did he have to be” issue.

Reader Nancy Kabat was puzzled by what seemed to be a switch on some Virginia personal property tax lists in the waning years of the 18th century.

She wanted to try to calculate ages of certain ancestors based on when they did, or didn’t, appear on those tax lists.

But she ran into a snag.

“I am researching my ancestors in Franklin County, Virginia from 1782 to 1823 and have collected their personal property tax records,” she wrote. “However, I am confused as initially the tithables are listed as white males over 21 and then in 1788 it switched to white males over 16. I thought it was always white males over 21. Am I missing something?”

So… first up, what’s a tithable? According to the Library of Virginia, “In seventeenth- and eighteenth-century Virginia, the term ‘tithable’ referred to a person who paid (or for whom someone else paid) one of the taxes imposed by the General Assembly for the support of civil government in the colony.”1

And these taxpayers were called tithables because the tax went, in part, to the support of the Anglican parishes2 — that being the established church of Virginia at the time.

That same law gave the first specific definition in Virginia law as to who was considered tithable: “all youths of sixteen years of age as upwards, as also for all negro women at the age of sixteen years.”3

That age of 16 for tithables, usually focused on white males, continued in the Virginia colonial statutes for more than a century.

And then came the Revolution, and statehood, and a whole new system of taxation.

With a new law enacted in November 1781, Virginia switched over to a new state personal property tax system which required a state poll tax to be paid by free males over the age of 21 (“a tax of ten shillings by every free male person, above the age of twenty-one years”).4 And that age of 21 for the poll tax was repeated in 1782 when Virginia refined its tax laws to bring various provisions under one legal roof.5

BUT…

It didn’t stay that way.

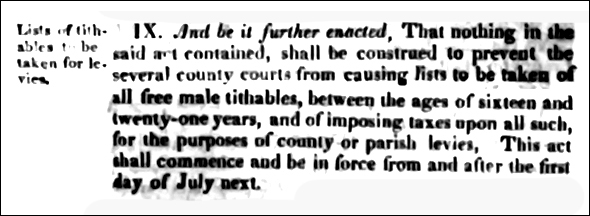

That age provision was clarified by an act passed on May 1783 that said: “nothing in the said act contained, shall be construed to prevent the several county courts from causing lists to be taken of all free male tithables, between the ages of sixteen and twenty-one years, and of imposing taxes upon all such, for the purposes of county or parish levies, This act shall commence and be in force from and after the first day of July next.”6

Which, of course, a bunch of Virginia counties did.

Including Franklin, which was counting white males aged 16-21 on its tax lists by 1788.7

Somewhere in the order books of the Franklin County Court between its formation in 1785 and the collection of that tax, there should be an order allowing it to be collected. I have to say “should be” because — sigh — court records are only as good as the clerks that created them and, of course, Franklin may have relied on earlier practices in its parent counties of Bedford and Henry.

So the bottom line here?

You already know it.

If we want to understand the records, we have to understand the law — at the time and in the place where each record was created.

And, very specifically, how old you had to be to pay a head tax in Virginia after 1783 was a matter of local law, right down in the weeds of the county level.

Cite/link to this post: Judy G. Russell, “A matter of local law,” The Legal Genealogist (https://www.legalgenealogist.com/blog : posted 12 May 2022).

SOURCES

- See “Colonial Tithables: Overview,” Research Guides & Indexes, Library of Virginia (https://lva-virginia.libguides.com/ : accessed 12 May 2022). ↩

- See, e.g., Act I, Laws of March 1642/3, in William Waller Hening, The Statutes at Large… of Virginia from … the Year 1619, vol. 1 (New York: p.p., 1823), 240, 242. ↩

- Ibid., at 242. ↩

- See “An act for ascertaining certain taxes and duties, and for establishing a permanent revenue,” Chapter XL, Laws of 1781, in Hening, The Statutes at Large… of Virginia from … the Year 1619, vol. 10 (Richmond: p.p., 1822) 501, 504. ↩

- See “An act to amend and reduce the several acts of assembly for ascertaining certain taxes and duties, and for establishing a permanent revenue, into one act,” Chapter VII, Laws of October 1782, in Hening, The Statutes at Large… of Virginia from … the Year 1619, vol. 11 (Richmond: p.p., 1823) 111, 112. ↩

- See “An act to amend the act To amend and reduce the several acts of assembly for ascertaining certain taxes and duties, and for establishing a permanent revenue, into one act,” Chapter XXXVIII, Laws of May 1783, in ibid., 289, 290-291. ↩

- See Franklin County, Virginia, personal property tax lists of 1788; digital images, DGS film 007849115, starting at image 80, FamilySearch.org (https://www.familysearch.org/ : accessed 12 May 2022). ↩

Woo hoo, the existence of the Franklin Co., Va., tax records—and the link to them in the main text in the email version of the posting—turned out to be a great find. On image 15 of the first batch of 616, I found one or perhaps two of my husband’s Binnion ancestors, among the 1786 personal-property-tax listings. Fortunately, I didn’t have to do very much browsing to find them.

I couldn’t read all the headings very well (due to scratch-outs and one I couldn’t decipher) but it’s a start. Now I shudder to think of making my way through the later years, which won’t happen anytime soon, alas. Too bad the names are not indexed, especially since I should look for the Dehavens also, not listed for 1786 but perhaps appearing later.

Interestingly, the Binnion family (of Sandy Springs, Ga., near Atlanta) intersected with the PettyPool line (of Pickens Co., SC,/the Greenville District of SC) when my husband’s maternal grandparents married in the 1880s in Georgia.

Glad this was helpful!!